Define Leverage In Forex Trading

Leverage is a kind of interest-gratuitous loan provided by a broker. Yous tin can employ leverage to increase the size of your position, and then, increase the returns. Or, you can apply leverage to reduce margin (the collateral demanded by the banker for the position opened).

Read on and you volition acquire what is leverage and how it works. Y'all will also learn how to calculate and find out the virtually optimal leverage. I will cover all the pros and cons of leverage trading and requite real examples of leverage forex trading.

The article covers the following subjects:

- What is leverage? Leverage Definition & Meaning

- What is Leverage in Forex?

- How Does Leveraging Work in Forex Trading?

- Leveraged Products (how to calculate leverage for different trading assets)

- Leverage Ratio: What is this?

- Leverage Ratios Examples in Trading

- What is the Best Leverage to Merchandise Forex?

- Leverage FAQs

- Conclusion

Yous will notice very useful and interesting data most what is leverage in forex!

What is leverage? Leverage Definition & Meaning

Imagine that yous buy apples in the wholesale market in a big metropolis and sell them in a local market in a modest town. It is clear that have a certain actress charge for providing the service of moving apples from the wholesale marketplace to the small town.

And the more apples y'all can purchase in the wholesale market, the more than yous will earn on the markup (provided that all the apples are sold out). Merely you have a express corporeality of cash. You understand that you can sell 5 times more apples in the local market, and yous get to a bank to take a loan.

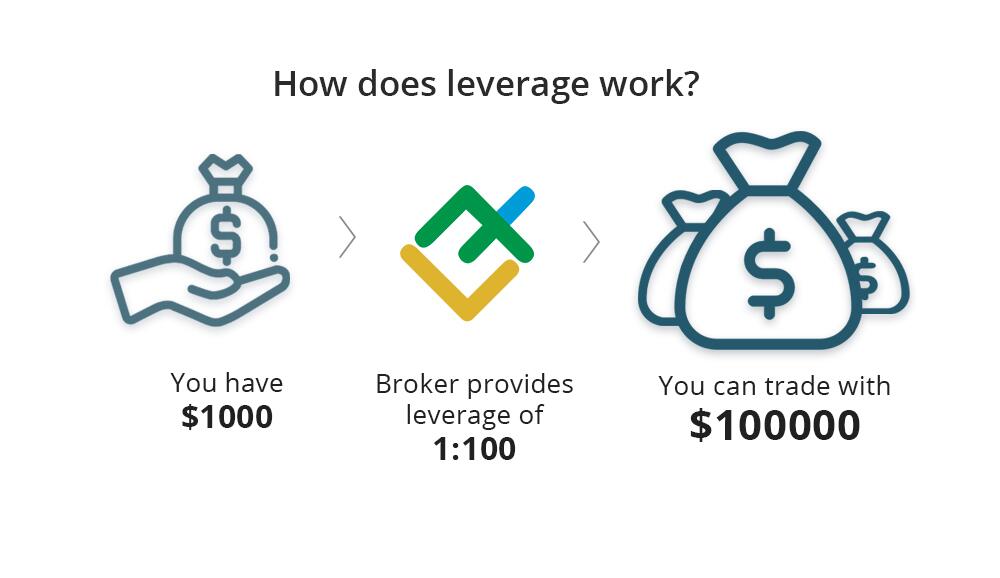

Forex leverage explained in uncomplicated terms is a kind of the bank loan provided by the broker to the forex trader. If yous have a relatively pocket-sized eolith and utilize the leverage, you can buy several times more currency or stocks, and so, make several times more than turn a profit.

What is Leverage in Forex?

Only in that location is a significant difference between a bank loan and the forex leveraging. A forex trader can utilize leverage whatever time for costless, the broker provides the loan with no interest charged on the amount of debt.

Financial leverage in FX trading is:

-

An option that allows a trader to enter trades with a volume several times larger than the actual amount of money on the trading deposit.

-

An instrument of margin trading, which is the funds you lot borrow to increase the position volume, and then, to increment your profit, in instance your disinterestedness is non enough.

-

The ratio between your deposit and the position volume you are opening.

The maximum Forex leverage is specified in trading weather for each type of trading account. For instance, the maximum leverage for one business relationship is i:200; for some other business relationship, it will be 1:1000.

An case of leverage in forex:

-

A 1:1 leverage ways that the trader trades merely with own funds. The ratio between the trader'southward deposit and the corporeality of money he/she trades. That is, if the trader has $100, he/she cannot open a position with a total book of more than $100.

-

A 1:1000 leverage means that the trader tin open a position of yard times more volume than the funds he or she owns. It means, if yous have $100, yous can open up a position of $100*1000 = $100 000.

Which leverage is the safest? The minimum commanded leverage is 1:1.

There is no upper limit, in theory, that is why you lot can come across the Forex leverage of one:3000. Yet, fiscal regulators strongly recommend brokers to lower the maximum limit of leverage to reduce the risk of losing the trader'due south deposit.

Leverage vs. Margin - the Divergence & Human relationship

Another definition of leverage is the option that increases the trader's funds given as collateral to open up and maintain a position.

For example, a i:100 operating leverage, in this case, means that to open a position of yard units of the basic currency, the trader volition need 100 times less money, which is x units.

This amount of coin is called margin, which is the sum blocked by the broker until the opened position is airtight.

Margin is the money needed as collateral that you should have on your business relationship to be able to trade Forex using leverage.

The general formula to summate margin looks like this:

Margin = position book (contract size, lot) / leverage

For example, if you utilize the leverage of one:2 to enter a trade of 100$, the margin requirement will be 00/two = $50.

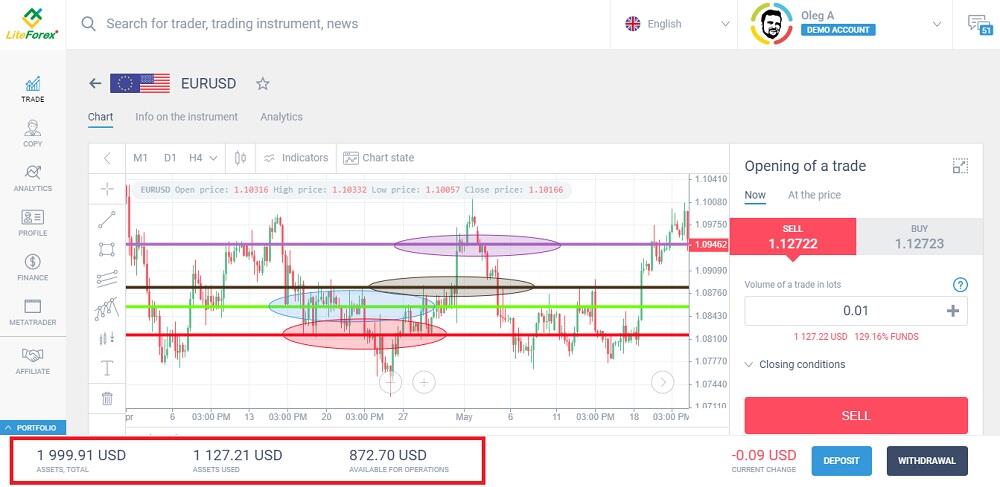

Allow us study the opened position on the EUR/USD with the leverage of i:i every bit an example:

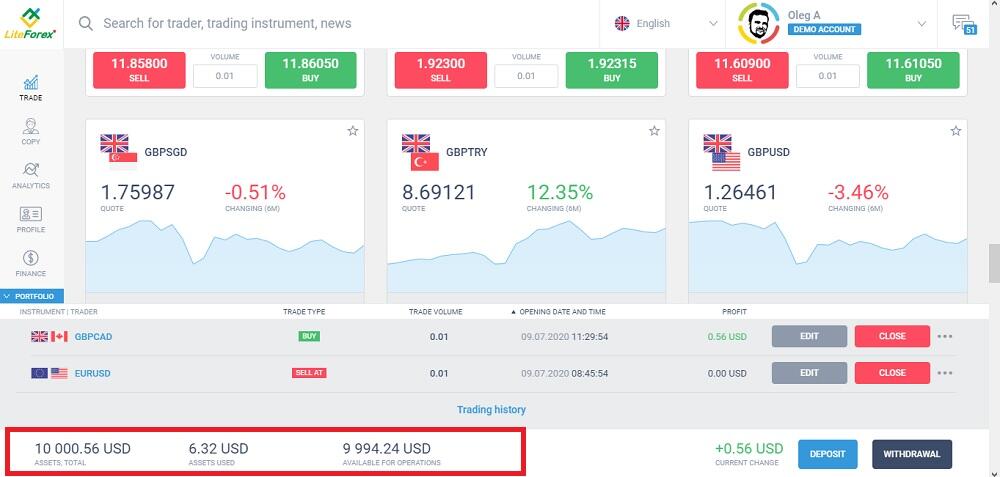

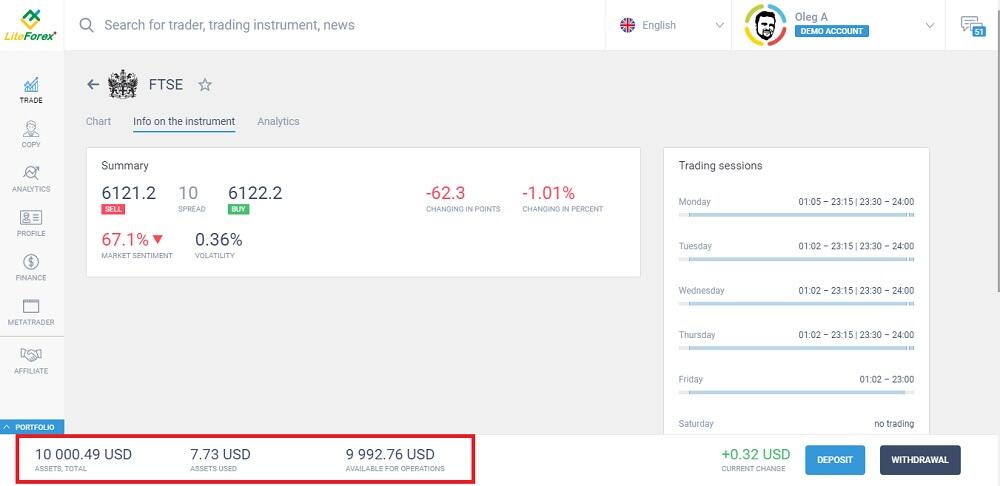

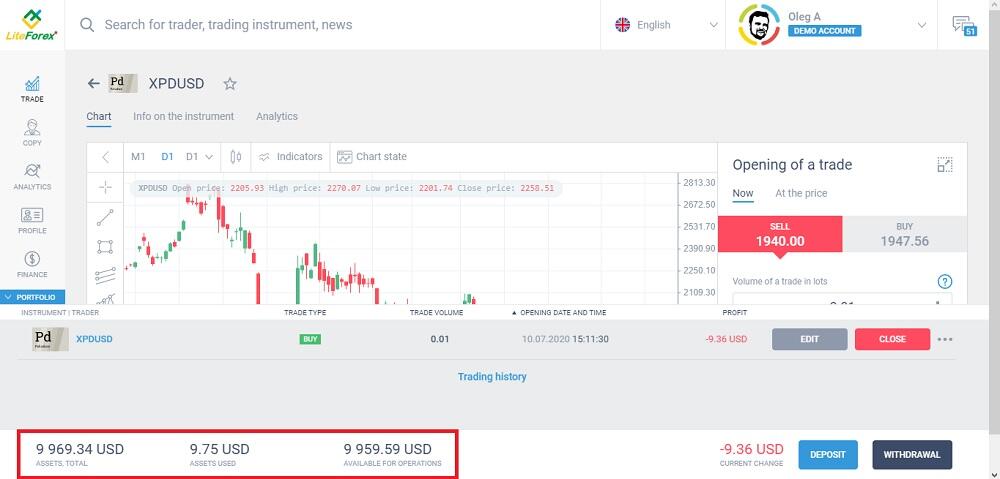

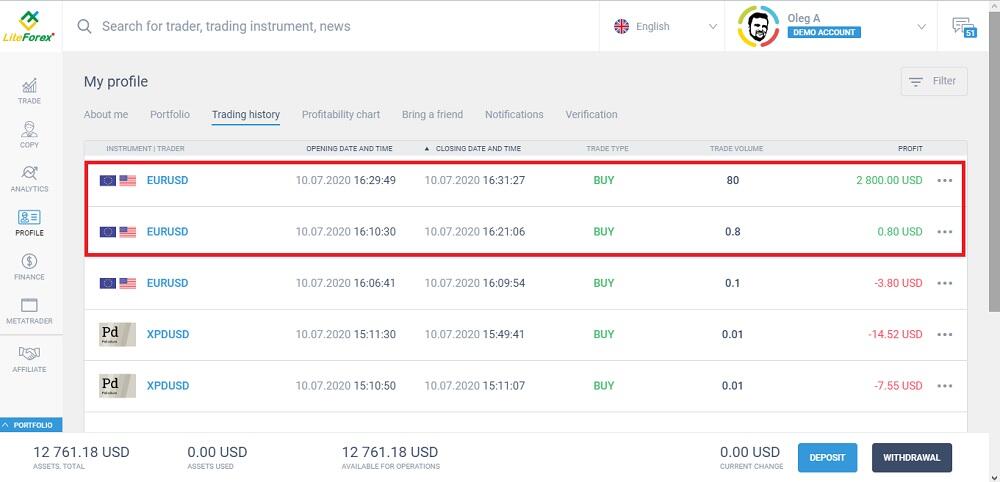

Assets full. This is the amount of funds on the trader'south eolith that is equal to the balance (the deposit corporeality at the time of the position opening + profit/loss yielded past the opened positions). That is the corporeality that will exist on the business relationship if the positions are closed right away. While positions are open, the amount is floating.

Assets used (margin, collateral). These are the funds the broker blocks when you enter a trade. This the amount of your deposit that direct relates to the leverage.

Available for operations funds is the amount of complimentary coin that the trader tin can use. It is calculated as the difference between equity and margin. The amount is floating, equally it takes into account the electric current profit/loss on the open positions.

In this case, I entered a trade a minimum lot of 0.01 (a smaller volume is not provided for past trading conditions), which required $ 1,127.21. This amount is reflected in the line "ASSETS USED" and I have a lilliputian more than $872 of free money. It ways that I cannot enter some other, I just do not accept plenty money.

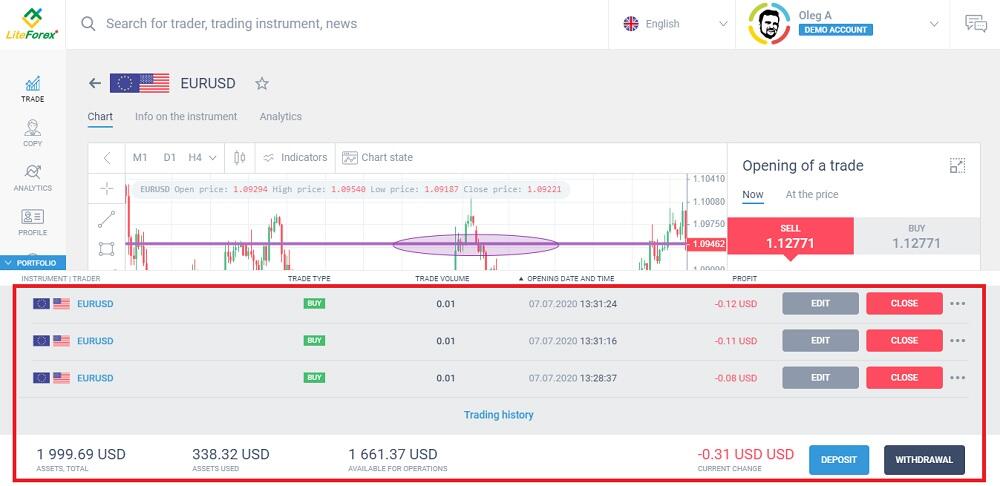

I open the same demo business relationship, but with leverage of 1:ten and enter 3 trades with a volume of 0.01 lots. With leverage of 1:ten, I need 10 times less coin to enter a like trade with the same effect. So, I tin enter 10 trades with a volume of 0.01 lots at the aforementioned fourth dimension (for example, for several instruments). Or I can enter i trade, simply with a book of 0.1 lot.

We should take a minimum deposit of lightly more than $1127.21 to enter a trade with a minimum book of 0.01 lots with a i: 1 leverage. With leverage of i:1000, the margin would be $ one,1272. That is, the amount of my own funds of $ one.xiii would exist enough to enter such a trade.

Another conclusion derived from this example. The college the leverage, the lower the margin, which means a trader has more funds left for trading. Learn what is the All-time Leverage Ratio for Forex Trading.

A curt summary. Margin is the corporeality of coin set aside by the broker when the trader enters a trade. It can be presented as a table:

| Leverage | Margin requirement (collateral held by the broker expressed as a percentage of the position book) |

| i:1 | 100% |

| one:2 | 50% |

| ane:5 | 20% |

| 1:10 | 10% |

| 1:100 | 1% |

| 1:1000 | 0,1% |

If you trade with a 1:ane leverage, the margin requirement is equal to the position volume (the broker holds collateral of 100% of the full corporeality of the position).

With a 1:100 leverage, if you enter the merchandise with the same book, the broker sets aside only one% of the full amount of the position.

Why Merchandise with Leverage on Forex Market place?

You can trade without any leverage at all. However, there are situations when leverage makes information technology much easier to reach your financial targets or/and increase your profits. For example:

- Y'all can open a position with the minimum commanded volume (it is usually 0.01 lots) even if you accept a small deposit. You can't enter a trade on some assets without leverage when yous take a eolith of 10$ (or even 100$). SO, financial leverage could exist the just chance for a newbie to start trading. You volition know more about this in the side by side part.

- You can heave the volume of your position. Imagine that your eolith allows you to enter the trade on the EUR/USD with a book of 0.01 lots, where 1 pip is 10 cents (for four-digit quotes).

Hither's an example: You are 100% sure that the toll will cover 10 points in the needed direction. Without leverage, you will gain 10*x = 100 cents ($1). Accept the Forex leverage ane:100 and enter a trade 100 times bigger, the trade book of which is ane lot. Your profit from 10 covered points will also be 100 times more - $100. Yet, the risk management rules say you should non enter a trade for the entire amount of your deposit, simply this is just an case, to demonstrate how leverage works in Forex trading.

- You tin can enter more trades, and so, boost your deposit. An example: yous have $100. When you open a position with a book of $100 (without leverage), the broker reserves it all right away to keep your position open up. The unabridged deposit amount is blocked, and you cannot enter more trades.

If you employ a 1:10 leverage, then the broker volition set aside only $10 for a trade of $100. Then yous tin can utilize the remaining $ninety to enter new trades. For instance, y'all can enter trades on other assets and thus diversify the risks.

You lot will improve understand what Forex leverage is if you lot open a few demo accounts with different deposits, dissimilar leverages, and enter a few dissimilar trades.

You tin do it by going through a few like shooting fish in a barrel steps:

- register a profile with LiteFinance (click on the Registration button on the top right corner). It won't take more than a couple of minutes.

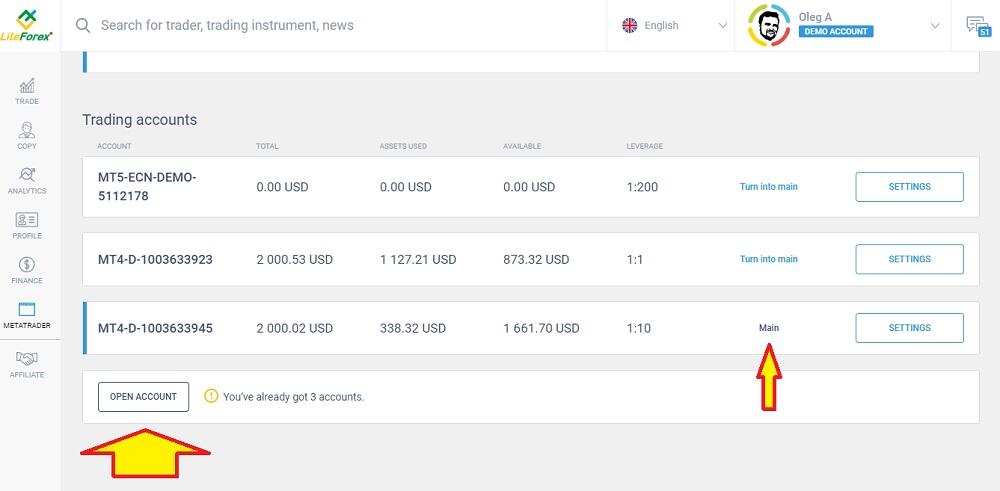

- click on the METATRADER tab on the right of your trading chart in your client profile.

Click on the OPEN ACCOUNT button, cull the leverage, and, after creating the account, set up it equally the primary account. Therefore, you will open both a existent and a demo account. To switch from one account to another, go to the Metatrader tab again and turn the required account into the main ane.

The demo account provides a leverage range from ane: one to 1:1000. On real trading accounts (Classic and ECN) a leverage range is also from i:ane to 1:1000.

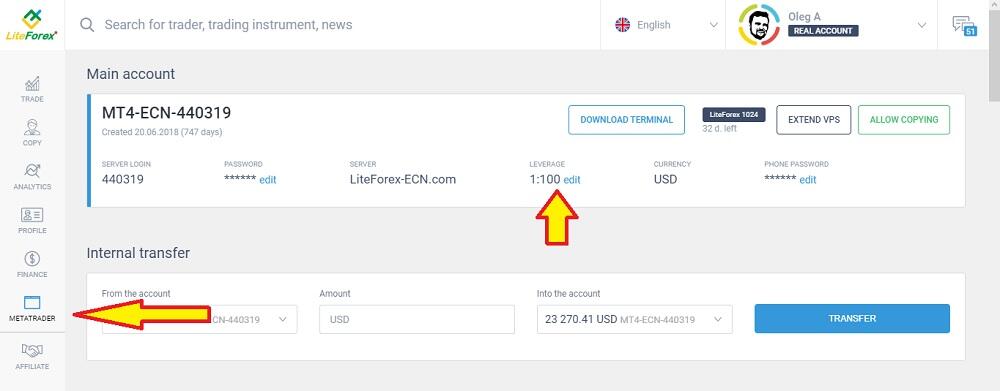

How to bank check your account leverage in the MT4 platform? There is non such an option straight in the MT4 (it doesn't make sense to summate based on the margin level).

Such an option is provided in the trader profile, where you lot tin also open an MT4 account and attach it to the terminal having a login and a password. You can see the leverage for each account in your profile. Yous tin can also alter the leverage entering the Metatrader carte du jour on the right.

How Does Leveraging Work in Forex Trading?

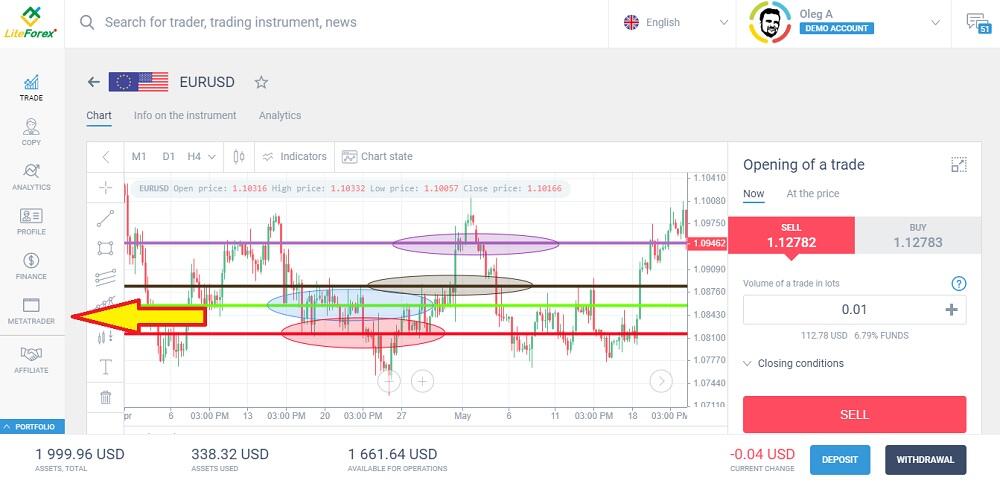

Permit united states see how Forex leverage works on the case of a real situation from the LiteFinance trading platform.

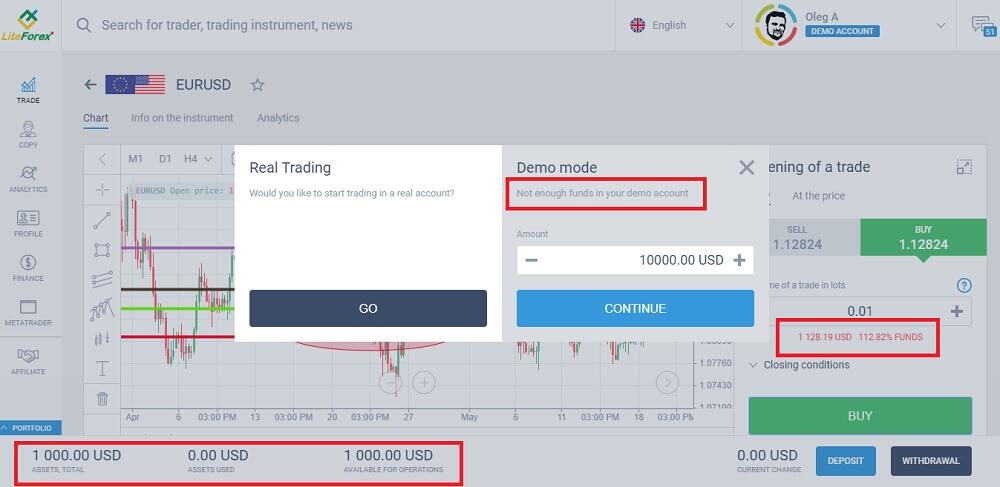

Suppose y'all take deposited $100 in your investor business relationship and want to enter a trade on the EUR/USD currency pair, whose current exchange is 1.thirteen. Co-ordinate to the trading conditions, the minimum merchandise volume is 0.01 lot.

According to the trading conditions, the minimum transaction book is 0.01 lot. Since i lot is 100,000 base currency units, the merchandise volume of 0.01 lot will correspond to grand units. That is, a trading book of 0.01 lot means that you tin buy at to the lowest degree thousand euros, for which you lot will need more than $1130. But yous have simply $100 on your account, and the platform simply won't let you open an lodge.

If yous employ the leverage of 1:10, you lot can already manage $1000. But it is yet not enough. It is clear from the effigy, having a deposit of $1000 y'all receive the bulletin the funds on your account are not enough? And you lot cannot open the position.

When you use the leverage of one:twenty (it is quite a safe leverage for a beginner trader in terms of risk management), you lot will exist able to enter a trade with a volume of 0.02 lots.

Leverage Pros

Pros of leveraged trading in Forex:

-

Y'all can enter trades with the volume much larger than your ain capital.

-

Leverage is an interest-free loan. To boost your deposit amount and enter trades with a larger book, y'all can have a loan in a bank, but yous will take to pay interest. Forex brokers do non accuse interest for providing yous with leverage.

-

You lot tin can increase your gains using leverage. If you lot increase your trade volume by x times using leverage, y'all will increase your profits also ten times (I wrote this before).

-

With the same trade volumes for the aforementioned asset, the deposit without leverage will be stopped out sooner than the trading deposit with the leverage.

Leverage Cons

The cons of trading with Forex leverage include:

-

Higher risks associated with the boost in the full volume of open trades. An increase in the book of positions also increases the value of a point. Therefore, your potential losses are also amplified. High leverage implies high potential profit equally well as high potential losses.

-

A margin call/stop-out. This trouble stems from the previous bespeak. If you enter the EUR/USD merchandise with a volume of 1 lot, one betoken costs $10.

If the position book is 0.01 lots, one bespeak costs ten cents. In the kickoff example, the eolith will be stopped-out much faster.

-

Psychological trap. When you lot have free funds spared from the margin requirement with the help of leverage. It can encourage y'all to heave your position volume adding up to a losing merchandise if you want to win back your losses. Information technology tin likewise result in unjustified conviction in potential profit.

Important! All the cons of leverage above are the drawbacks merely when a trader forgets about the rules of risk management and increases the position book beingness ruled past emotions. If you employ the broker's leverage (even high leverage) without making the position volume bigger, it is non associated with any risks.

Leveraged Products (how to calculate leverage for unlike trading assets)

So, now I believe you empathise the general meaning of margin and leverage. Let me summarize briefly:

- Fiscal leverage is the involvement-free loan provided past the banker, which allows buying much more avails or to reduce the margin, sparing the funds that would exist reserved by the broker as collateral.

- Margin is the trader's funds reserved by the broker as collateral (real funds on your business relationship) when he/she enters a trade. It is calculated according to the formula Position book/Leverage.

- A terminate out in Forex is the level at which all of a trader's active positions are closed automatically by their broker, It is calculated equally a percentage of the Level established by the trading conditions. The level, in turn, is calculated as Assets total (or funds full)/Assets used (Margin, collateral)*100.

The higher up concepts are needed to develop the adventure direction organisation and summate the acceptable level of risk. The above formula is relevant only for currency CFDs traded in Forex. For other trading instruments, the adding formula is dissimilar. Too, the concept of leverage in the stock exchange, for instance, is different from the definition of the Forex leverage as the borrowed funds provided past the broker.

1. Currency trading (direct quotes, indirect quotes, and cross rates)

1.i. Directly quotes.

A directly quote is a foreign exchange rate where the USD is in second place in the fraction.

Margin = Position volume* Contract size/Leverage*Open up price (substitution charge per unit)

An instance. The EUR/USD currency pair refers to directly quotes.

The exchange rate i.13 ways that the trader needs $113,000 to purchase 1 lot (100 000 euros).

Or $ 1130 for a minimum merchandise volume of 0.01 (1000 euros).

With a one:100 leverage, the margin will exist 0.01*100,000/100*1,13, where:

- thousand - euros, the volume of the currency being bought (position volume).

- 100 - Leverage.

- i.13 — the commutation rate.

The margin requirement will be $eleven.3.

That is a hundredth of the amount of money that a trader will spend to buy grand euros (0.01 lot).

1.2. Indirect quotes

An indirect quote is the currency quote where the USD is in the beginning identify.

Margin = Position size/leverage

An instance: The USD/CAD currency pair is an indirect quote.

Since the collateral is calculated in the beginning currency for this currency pair, in this case, it volition be calculated in USD.

A 0.01 lot merchandise means that the trader will need $1000 to buy the Canadian dollar.

With a leverage of ane: 100, the margin is: 0.01 * 100,000 / 100 = $ten.

1.3. Cross-rates.

A cantankerous-rate is a currency exchange rate that doesn't include the USD. Simply the collateral hither is also calculated in the currency that is in the first place in the ratio.

Margin = Position book*Contract size/Leverage*the price of the first currency in USD

An example. The GBP/CAD currency pair is a cross-charge per unit.

0.01 lot means that a trader buys one thousand pounds for one Canadian dollar.

As the trader's base currency is the US dollar, the amount of coin indicated in the Assets Used section volition be expressed in the USD.

With a ane:200 leverage, the margin is 0.01*100 000/200*ane.2639 = half-dozen.319

- 1000 - minimum lot (0.01).

- 200 - leverage.

- 1.2639 - GBP/USD exchange rate (a slight divergence from the figures in the screenshot results from the floating charge per unit).

This margin value you see on the screen, in the Assets Used tab.

ii. ETFs

In that location is a significant difference in how the leverage is practical to the exchange marketplace, which is authorised and regulated, and over-the-counter market place.

2.1. Commutation-traded indexes.

ETF is an index fund whose shares are traded on an exchange. It is based on a structured portfolio of assets, often having fixed costs.

Buying shares of an ETF fund, a trader really invests in a consolidated investment portfolio, which can take a diversified structure or consist of instruments of a sure segment.

A leveraged ETF allows y'all to increase the profitability of the shares by the leverage size. For case, if you lot invest in a NASDAQ ETF without leverage, y'all will take a ane% turn a profit if the index rises by 1%. If you invest in an ETF using leverage, you will make two%-3% turn a profit from the index growth by one%. Such ETFs are likewise referred to equally margin trading ones.

ii.2 Forex indices.

You can as well merchandise indices with a Forex broker. The advantage of Forex index trading is that at that place is a lower entry threshold and less formal procedure ruled. Trades are entered in a couple of clicks.

Margin = Position book*Contract size*price/tick size*tick value*margin percentage/100

All the data needed for calculation from the contract specification, which you can find in the trading instrument information on the LiteFinance website.

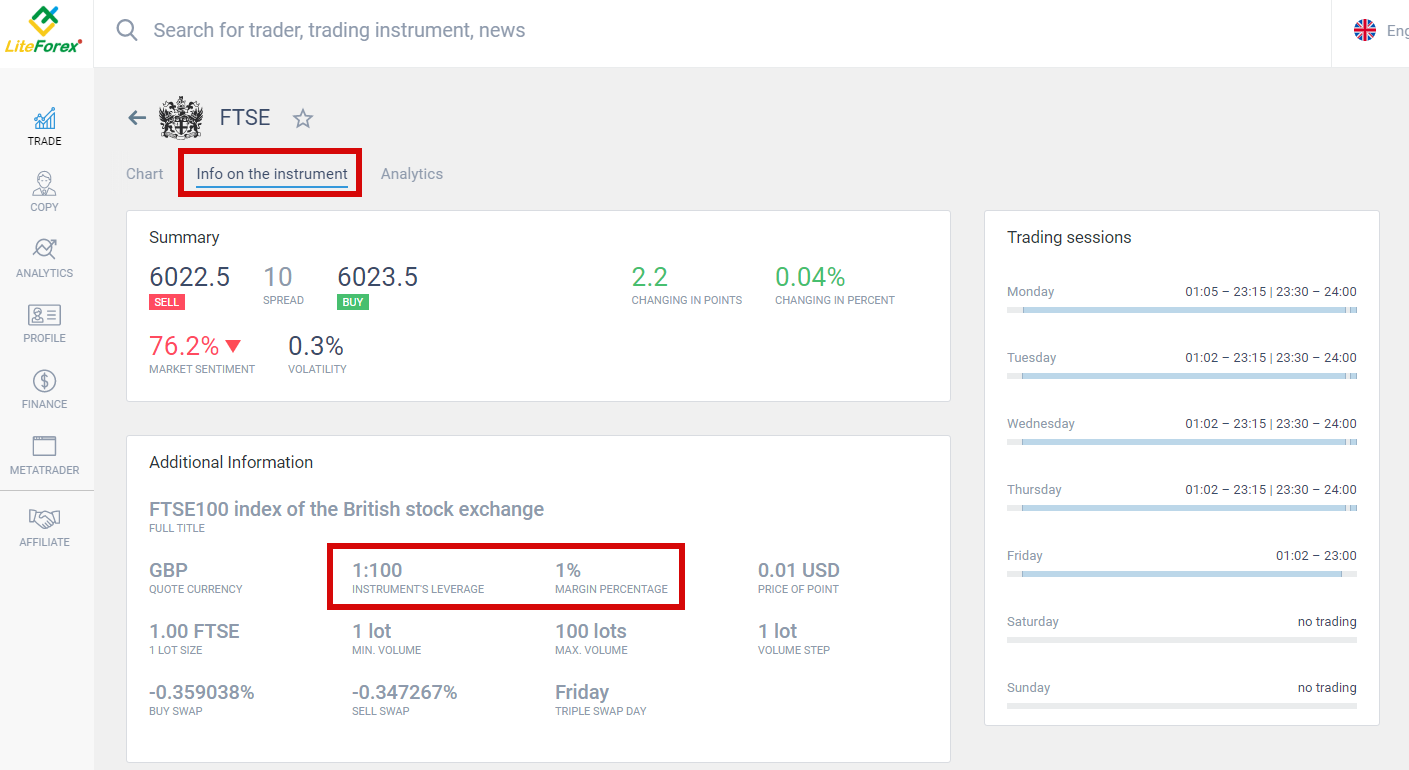

Cull an musical instrument you lot want to know the specification on. In this case, it's the FTSE alphabetize.

Position volume is the volume you lot are going to buy in lots. The contract size, betoken size, margin percentage – all these data are found in the contract specification. The margin pct of ane% means that 1:100 leverage is used on the instrument.

Collateral (margin) = 1*1*6111.vii/0.ane*0.01*1/100 = 6.1117, where:

- ane – position volume. It corresponds to 1 lot, y'all cannot fix a smaller volume.

- 1 – contract size, specification information.

- 6111.seven – contract price.

- 0.1 – tick size.

- 0.01 – tick value. Note that the MT4 screenshot displays 0 in this department. This is the flaw of the platform, which rounded the value down for this contract.

- 1 – margin percent. Information technology is an analogue of leverage.

Equally the margin currency is the GBP, and the eolith currency is the US dollar. Nosotros shall correct the substitution rate, 6.1117*1.2639 = vii.73. That is the margin requirement for the contract expressed in the USD.

Important! Note that in Forex indices trading, the leverage does not matter, since it does not take function in the margin calculation formula.

The so-chosen margin pct is considered here. The margin pct is set up past the broker for each alphabetize. The percentage depends on the liquidity provider. The position amount is corrected by this coefficient.

In this case, the margin percentage can be chosen an analog of leverage. This is the percentage taken from the margin if we assume that there is no leverage.

For example, the margin percentage of 10% corresponds to the i:ten leverage. The margin per centum of 1% corresponds to the 1:100 leverage. You volition run into how it works in more particular farther when I explain the examples of particular assets.

3. CFDs

CFD is a contract for difference, this is the major instrument traded in the Forex (it is besides popular in exchange markets).

Trading CFD products doesn't require a real exchange of shares, metals, or other commodities, for case, oil. When the transaction expires, the electric current cost is compared with the toll relevant at the time of the contract decision. The heir-apparent and the seller make the common settlement.

Some other reward of Forex CFD trading is high leverage, which allows boosting position volumes by 100 and even 1000 times. It refers to CFDs on currency pairs. In trading oil CFDs or shares, the leverage works differently.

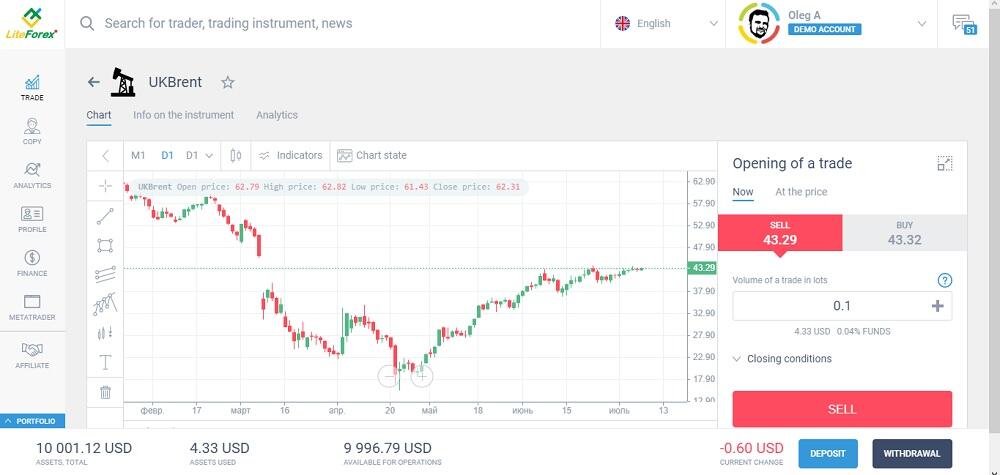

Margin = Position volume*contract size*margin pct/100

You take all the needed data from the contract specification. Annotation that in the specification of the oil contract, you should specify the type of the margin calculation. It depends on the liquidity provider and can be calculated using the index formula presented in the previous section.

Margin (assets used) = 0.1*ten*43.iii*10/100 = 4.33, where

- 0,1 - the minimum possible position volume.

- 10 — contract size found in the specification.

- 43.3 - price.

- 10 — margin per centum from the specification.

The leverage of the trading account doesn't matter hither too. Simply in fact, the leverage here is 1 to ten, which is not provided past any substitution.

4. Options

An option is an exchange contract that is concluded between two parties and gives its buyer the correct to purchase or sell an asset in the future at a preset price and date (the expiration date).

The leverage works in options trading in the following way: the cost of options contracts is typically much lower than the cost of their underlying security.

Buying options contracts allows y'all to manage a greater amount of the underlying security, such as stocks than you could by really trading the stocks themselves.

For example, having the same amount of coin, yous could buy 10 shares or an option to command 100 shares. If you use leverage in trading options yous can create the potential for far higher profits through buying options than you could through buying stocks.

five. Crypto

5.1. Cryptocurrency exchanges

In crypto exchanges, the leverage works in the same manner every bit in Forex trading, it is used to increase the book of the positions you open. However, exchanges are not equally generous as brokers. Well-nigh often there are leverages of one:2 -i:five.

five.ii. Trading crypto with a Forex broker

Compared to crypto exchanges, trading cryptocurrencies with Forex brokers has several advantages:

- Verification is much easier here, there is regulation and protection of the client residue, while cryptocurrency exchanges have been repeatedly hacked and scammed.

- You can open short positions (sell trades) with a banker.

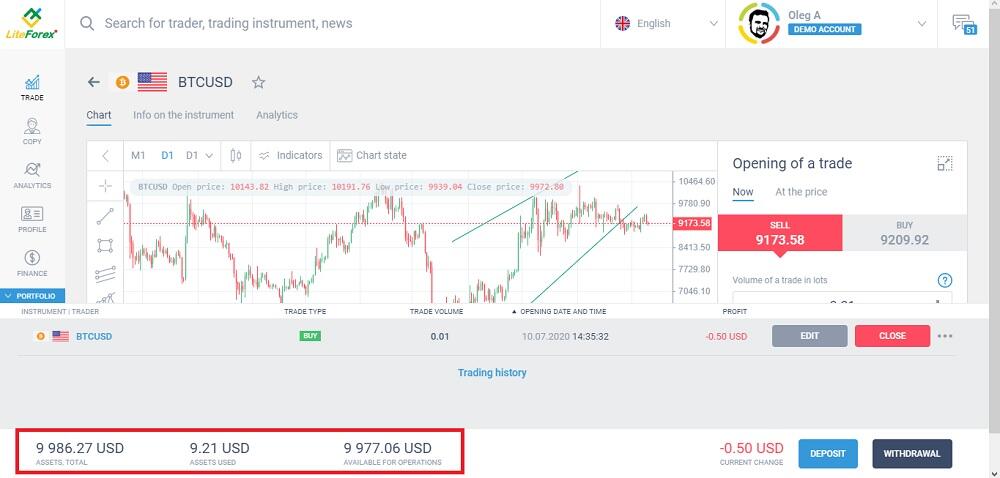

- Brokers accept higher leverage (margin percentage). A sure margin percentage serves every bit leverage and is i to 10. Let'south have a look at how margin in crypto trading with a broker is calculated

Margin = Position volume*contract size*margin pct/100

Collateral = 0.01*1*9213.12*x/100 = 9.21, where

- 0.01 — Position volume (the minimum lot is 0.01, it is more user-friendly the trading instruments where the lot book starts with its integer value).

- 1 — Contract size, taken from the specification in the MT4.

- 9213.12 — the BTC/USD price.

- 10 — margin percentage, besides taken from the specification.

Margin currency is the USD, so the consequence will correspond to the eolith currency.

6. Futures

Like stock indices, futures are traded both on the exchange and over-the-counter.

half dozen.1. Stock commutation market place

Unlike the leverage in stock trading, where the broker provides a one: 2 leverage maximum and charges interest when the position is rolled over to the next day, leverage in futures trading is free. This follows from the concept of the futures itself, where the settlement is fabricated at the end of the contract.

For instance, if the cost of a CAD/USD futures contract is $vii,370, then you do not need to pay the entire amount at once. It is enough to deposit a guarantee on the exchange, for example, $737 with a i:10 leverage.

half dozen.ii. The OTC market

Hither, everything also depends on the Margin percentage set past the broker.

Margin = Position volume * contract size * price * margin pct / 100

7. Metals

This is another example of how important information technology is to pay attention to the type of margin adding in the specification. This line defines the formula for calculating the margin. Metals and oil are referred to every bit commodity markets.

Even so, the CFD formula is used to calculate margin requirements for oil, gold, and silverish, while palladium, for example, is an exception. It uses the CFD-Leverage formula, that is, the Forex leverage is taken into business relationship.

Margin = Position volume * contract size * toll / Leverage

Margin = 0.01*100*1949.16/200 = 9.75, where:

-

0.01 - position volume (minimum lot - 0.01).

-

100 - the contract size defined in the specification.

-

1946.xvi - the current price at which the position is opened.

-

200 - leverage 1:200.

Different oil or indices, leverage is important in trading metals. I would like to emphasize that information technology is you who chooses the leverage, and yous can change it at any moment.

The margin percentage is a fixed value set by the broker and specified in the instrument specification.

8. Stocks

Like other types of securities, it is possible to make money on changes in the value of the shares both on exchanges and in over-the-counter markets.

8.1. Trading equities on the stock commutation

When buying shares on the substitution, the trader becomes their direct possessor.

Even so, the minimum deposit to trade on an exchange can start from several thou US dollars, and commission fees for beginner traders are sometimes besides high. Leverage is provided past a broker, but it is unremarkably low, about 1:ii.

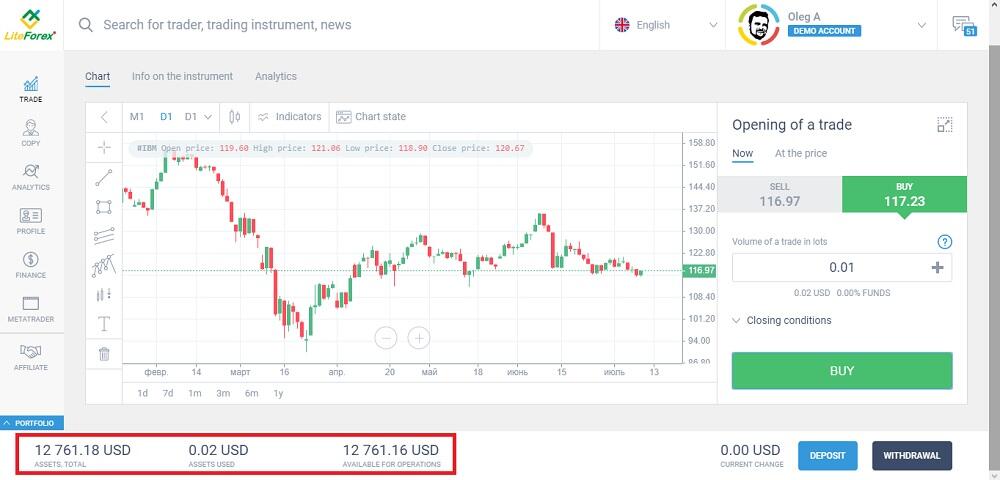

eight.2. Trading equities in Forex

Unlike trading in the stock market, there is a low initial deposit. Instead of leverage, the margin depends on the margin percentage.

The formula for calculating the margin for trading shares in Forex is similar to the formula for the margin calculation for CFDs

Margin = Position volume * contract size * price * margin per centum / 100

Margin = 0.01*1*117.23*2/100 = 0.0234, where:

- 0.01 - the minimum position volume for this instrument.

- one - the contract size. Information technology is the constant taken from the specification.

- 117.23 - position opening price.

- 2 - margin pct. It is defined in the specification.

Leverage Ratio: What is this?

In economics, the financial leverage ratio shows the existent ratio of own and borrowed funds in a concern. This indicator allows you to assess the stability of the company and its profitability level. In Forex, this term has a bit of a different meaning. Forex leverage is the equity ratio for a margin buy.

Leverage ratio formula

The coefficient formula is simple: ane / leverage. For case, the leverage ratio for a 1: 2 leverage is 1/2 = 0.5. For a 1: 100 leverage, the leverage ratio is i/100 = 0.01.

An instance of computing margin requirements and business relationship remainder:

- Yous take a deposit of $3000. You want to buy i lot of the euro (100 000 EUR) at a toll of one.2 USD. The broker offers for this pair the maximum leverage of 1:fifty.

The leverage ratio is 1/50 = 0.02.

Margin = 100,000 * one.2 * 0.02 = $2400 - this is the amount of coin that volition be reserved by the broker at 1:50 leverage.

- Free funds (available for operations) are 3000-2400 = $600.

- With the leverage of 1:fifty, you lot can manage the funds of 600 * 50 = $30,000. With this money, you can purchase 30,000 / i.2 = 25,000 euros. In other words, the margin for buying 25,000 euros at a leverage of one:50 would be $600.

For the amount of $3000 with the leverage of i:50, y'all can buy 125,000 euros in total. A simplified calculation will look like this: purchase amount = 3000 * 50 / i.ii = 125,000 EUR.

Earlier calculating optimal Forex leverage, I recommend using the forex calculator, which has a lot of other useful data in addition to the margin data. It looks like this:

Forex leverage reckoner

Don't know how to calculate leverage in the Forex market? Employ the leverage calculator. It's extremely like shooting fish in a barrel to use:

- Cull a currency pair or any other nugget you are going to trade.

- Choose the leverage you are going to use.

- Choose the lot size of the position you are going to open up.

That's it. The figurer will show the corporeality of margin you will demand to open up a trade with the chosen leverage and, autonomously from that, the real cost of such trade if no borrowed upper-case letter is used.

For example, to open up a buy position on the EUR/USD with a volume of 0.01 lots and a one:100 leverage, the margin will be $11.32. Differently put, to purchase 1000 EUR, you lot demand $1132, merely 1/100 of this amount, $ 11.32, is enough to enter the trade.

Endeavour it yourself:

You lot may also be interested in other articles that will help y'all calculate the optimal position volume, taking into business relationship the individual level of run a risk:

How to calculate a lot in Forex?

How to calculate the margin level in Forex?

Leverage Ratios Examples in Trading

To explain to you the difference between a depression leverage trading and a high forex leverage trading, I will again utilise the EUR/USD pair as an instance. I volition use a 1:10 leverage and a 1:1000 Forex leverage.

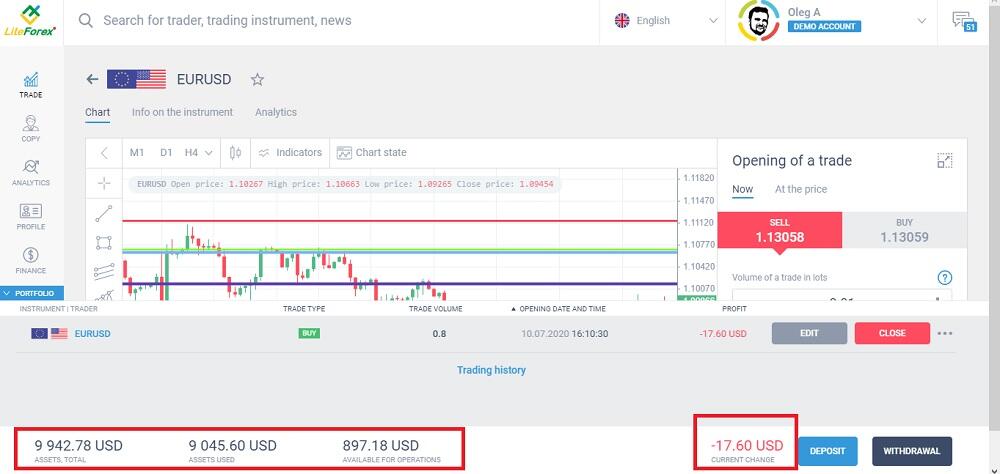

There is a fiddling less than $ 10,000 on the eolith. It means that with leverage of 1:10, I can enter a trade with a volume of 0.8 lots (collateral = 80,000 / 10 * 1.13 = 9040).

Avails bachelor for operations are a little less than $g. Note the electric current change. In a few minutes of the trade beingness held in the market, the floating loss amounted to a two-digit number.

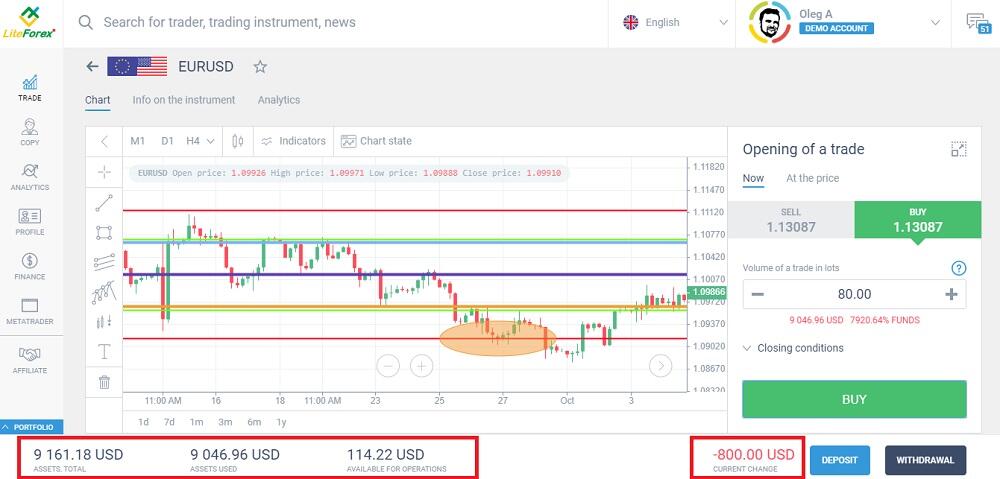

At present, I modify my leverage to 1:thousand. With the aforementioned deposit, I can open up a position for lxxx (!) lots (collateral = 8,000,000 / 1,000 * 1.xiii = 9040). That is, having a eolith of a little less than 10,000 USD, I tin buy 8 million EUR.

At present, the current profit/loss is a iii-digit number, although the amount of assets used is the same. Notwithstanding, the corporeality of the assets available for operations is much less, as the point value is much college because of higher leverage. I wait a few minutes and go out the trade.

The above effigy displays the results of 2 trades with leverage of 1:x and that of i:1000. The positions were held for just a few minutes. The deposit is the same, as well as the collateral. In the first case, the profit is $0.8, in the second case, it is $2800.

At first, the reward of high leverage seems obvious. But think that as the trade size increases, the pip value as well increases.

In the case of the lower leverage, the available funds are well-nigh $900. In the case of very loftier leverage, there is less than $150 is available for operations.

If the cost goes just a few points in the reverse management, the trade volition stop-out. With the leverage of 1:10, the price range is much longer, so the trade is much safer.

Conclusion. The higher is the leverage used to increase the book of the transaction, the greater is the potential profit. Still, in that location is also a greater risk that the trade will be stopped-out and the deposit volition be lost.

I will further explicate how to choose the level of leverage and how to employ leverage in Forex trading.

Using Maximum Leverage Examples

Example i. Imagine that you pick up a practiced moment when the EUR/USD trend starts. Y'all take $120 on your deposit and the electric current exchange charge per unit is 1.2. You lot have a ane:1000 leverage and y'all already have $120,000 and you can buy 100,000 EUR (that is ane lot). The EUR/USD pip value for the merchandise volume of 1 lot is $x.

Information technology ways that, if the price covers just 12 pips, all the deposit will exist lost (permit'southward presume the stop out level is 0). You open up the volatility figurer and run into that the EUR/USD average volatility is well-nigh 80 pips.

Determination. If you use a 1:grand leverage, you are likely to lose the entire deposit. In case of the tendency reversal or a local correction, the price volition surely cover 12 pips.

Example 2. Imagine you have $1200 in your deposit, So, yous tin can enter one trade with a volume of 0.01 lots. Without leverage (a 1:one leverage), the margin will be $1200. But y'all want to hedge against the hazard and enter another trade for a negatively correlated asset.

You take a one:yard leverage, the margin will be $1.2. You tin freely control the remaining $1198.8 and enter a merchandise for another asset with the same volume of 0.01 lots.

Conclusion. Using the maximum Forex leverage, y'all exercise not take a chance anything, as the total volume of the trades entered volition be 0.02 lots (the pip value will be calculated in cents and the reverse price move will not destroy the deposit). On the other manus, your turn a profit won't be much likewise.

Example 3. The position corporeality for each of the 2 orders is $5000. The first position is opened with a 1:1 leverage, the margin is $5000. The 2d position is opened with a one:100 leverage, and the margin is $50. the level formula is Disinterestedness/Margin*100%. End-out is the level, at which all the positions will be forcibly airtight (for case, a stop-out level of 20% ways that upon reaching the 20% Level, all positions will be closed automatically).

Since the amount of an open position (numerator) is the same in both cases, the merely difference is in the denominator. Therefore, in the first case, the Level value will be greater than in the second.

Conclusion. With the same volume of positions in the issue of a loss, the position with leverage will exist stopped-out later than without it. Differently put, using leverage volition reduce the risk of a stop-out.

The Risks of High Leverage

At that place is only 1 major risk of trading with leverage. If the leverage is used to increment the total volume of the position, the potential loss grows proportionally to it. On the one hand, high leverage is an opportunity to brand a lot of coin in Forex, on the other hand, you tin can quickly lose your deposit.

Advise:

To lower the high-leverage trading risks do not apply all the deposit at once. Utilise no more than 2% of your eolith for each trade.

Using Less Leverage Examples

Instance 1. The EUR/USD exchange rate is one.2. Your deposit is $1200. If you open a position with the minimum possible volume of 0.01 lot, the margin will be $ 1200, free funds available for operation are equal to zero.

Suppose you uncertainty the direction of cost movement and want to lock this position without topping up the deposit with real money.

Yous take a 1:2 leverage. This reduces the amount of the collateral by half. So, you will take more assets available for functioning and you tin can open a second equivalent position to lock the first trade.

Conclusion. Low leverage tin can be beneficial in some cases when you do not accept enough of your own funds.

Example 2. With the same inputs, you open a position with a volume of 0.01 points. But your forecast has been wrong and the toll goes 10 pips in the contrary direction. The pip value for 0.01 lot EUR/USD with 4-digit quotes is 10 cents, your loss is $ 1. Next, y'all accept a 1:two leverage and open up a position of 0.02 lots with the aforementioned margin. The price motility by ten pips yields you lot $2 of turn a profit, compensating for the previous loss.

Determination. In some cases, Forex leverage can help you to compensate for the loss, by doubling the position volume according to the Martingale way.

What is the Best Leverage to Trade Forex?

As practice shows, more 40% of traders prefer leverage up to ane:x, about 17% use leverage more than than i:100. European regulators for several trading instruments recommend the Forex brokers to limit the maximum leverage to 1:20 - 1:50.

Cryptocurrency exchanges most unremarkably gear up leverage of 1:2 - 1:5. Leverages up to i:grand are chosen by traders ruled by an emotional desire to increment the position volume to the maximum possible without plenty of own funds in the deposit. I usually do not seriously consider brokers, which offer leverage more than than chiliad.

I will recommend beginners to beginning with the minimum leverage value of 1:1 on a demo account.

Before trading with borrowed funds, a trader should first:

- Learn to build and adjust the run a risk management strategy for each trading arrangement. They should cautiously increase risks in at-home trending markets and reduce risks in case of strong volatility.

- Acquire to employ unlike trading systems, apply indicators, operate on trading platforms, and so on.

- Learn to control emotions, eliminating greed, excitement, and the want to win back the loss.

Only when beginners are confident in their skills and abilities and can exercise all the above, they can kickoff trading on a existent business relationship. On a real account, good leverage for a beginner is 1:x. This forex leverage will allow them to open up postions of a minimum lot of 0.01 having a relatively small eolith.

What leverage practice professional traders use? Only experienced traders themselves can answer this question. Traders employing forex pipsing and scalping strategies often apply high leverages. Their profits are a few pips with short stops, and so the loftier pip value is important for them, which is determined by a big position volume.

Traders who prefer long-term trading strategies attempt not to use loftier leverages. So, you should yourself consider whether to use high leverage or low leverage. You tin acquire more near how to choose the best leverage to trade Forex here.

How to Manage Leverage Hazard on Forex: five Tips for Beginners

A few tips for beginner traders:

- Follow the primary adventure direction rule "do not risk more than than 5%of the deposit per trade". Information technology is about the ratio of the position book and size of the stop loss. For instance, for a $ k deposit, the risk per trade should not be more than than $50. This corresponds to 5 points for a trade volume of 1 lot (i:100 leverage) or 500 points for a position of 0.01 lot (ane:2 leverage). According to the volatility calculator, the daily price modify for the EUR/USD pair is 80 pips. This means that with a merchandise volume of 1 lot, the "run a risk of v%" dominion will be violated.

- Use forex calculators to summate the lot and the margin. They volition help you to find out the amount of free funds and what leverage is safe on your state of affairs.

- Use terminate loss. If you have fabricated a mistake with the leverage and the pip value turned out to be much higher, the stop loss will shut the position in fourth dimension. You will learn a lesson without losing your deposit.

- Control your emotions. Do not employ the leverage to boost your position volume trading the Martingale way. Practice not boost the position volume if it contradicts the risk direction rules, fifty-fifty if you lot are 100% sure that it volition exist profitable.

- Railroad train your trading skills on a demo account. Choose the most suitable leverage, which corresponds to your trading mode, and merchandise on a demo account.

What is the all-time leverage to use in Forex? It is such leverage that will yield you a high profit with your initial deposit and an optimal take a chance level.

Summary. All the above may seem as well complicated at first. Leverage, margin, different calculation formulas, take chances management.

All of this seems difficult until you endeavor it in practice. These are the basic concepts y'all can't do without in trading. If you want to learn how to make money on Forex and other markets, permit me requite you some more recommendations:

-

Open a demo business relationship. Information technology will take a couple of minutes and doesn't require verification. Study the functions of the LiteFinance client profile.

-

Try entering beginning trades with different leverages. Come across the difference, compare different trading instruments. You should tape all your orders in a trader's diary.

-

Do enquire questions and share your ideas! You can write them in the comment sections below this article. You can also written report with a trading mentor/tutor, who you tin can observe among your more than experienced colleagues who have proved to exist successful.

Leverage FAQs

Forex leverage an involvement-free loan provided past a broker that allows y'all to merchandise more money than you really take. Differently put, this is the ratio of your ain funds and the volume of the position you lot open.

Financial leverage works in the following fashion:

- Information technology can increment the position size. For instance, if you have $100 on your deposit and use a one:10 leverage, you can open a position of equally much every bit $m.

- It can reduce the amount of money reserved past the broker as collateral. For example, if you lot have $100 on your account and y'all open up a position of $100, the banker will set aside $100, that is all your coin (Costless margin =0). If you utilise a 1:10 leverage, the broker will reserve $10. You tin utilise the remaining $90 to open more positions, including the trades on other trading instruments.

Forex leverage is the fiscal leverage provided by a Forex broker that allows a trader to open positions with the funds, several times (up to 1: 2000 and more than) exceeding the amount of the trader's own funds. Optimal forex leverage is calculated based on the risk management system.

Good financial leverage is the coefficient that will allow you lot to make the maximum profit while following the gamble management rules and reducing the risks. Adept leverage for a beginner is 1:ten - 1:20.

Information technology depends on your trading skills. Leverage is skillful for a professional person trader. But it tin be dangerous for the trader who doesn't know how to wisely use leverage.

If you utilise leverage to greatly increase your position in social club to get the maximum profit and forget about risk management rules, you will end upward with great losses. A professional trader knows how to cull the financial leverage wisely, based on the optimal relation between the position book co-ordinate to hazard management and the chance level suggested by the strategy.

The minimum leverage ratio is 1:1. It means that a trader can open a position with the maximum volume corresponding to the ain funds on the deposit. It doesn't involve funds borrowed from the broker (it can exist said there is no leverage).

The potential profits are increased because of the increment in the position book. If the position volume is doubled, the potential profit besides doubles. Leverage is but a tool to increase the merchandise size. It tin can besides exist used to reduce the amount of the collateral with the same position volume.

A 1:1000 leverage means a trader can control grand times more money than he/she really has. For example, you lot tin open a position of $100,000, having a deposit of $100.

A 1:500 leverage means that the allowable position book can be 500 times more than the trade'south deposit. For example, if you take $10 on your deposit and use a i:500 leverage, you can open up a position of $5000.

The best leverage for a beginner, who is just getting familiar with the nuts of forex trading is 1:one. It makes sense to start margin trading only when a trader learns to build the take chances management system, studies the principles of forex trading, and develops a trading system that yields steady profits.

For a real business relationship, optimal forex leverage is ane:10. It doesn't involve meaning risks, being inside the limits recommended by a regulator, and allows opening trades with a minimum allowing the book of 0.01 lot having a relatively small capital.

The danger of financial leverage has a solely psychological nature. The loss depends on the position book, non on the leverage amount. For case, if you open a EUR/USD position with the book of 0.01 lots, and the toll (quoted in four digits) goes 1 pip in the direction opposite to what yous have expected, you lot will lose x cents. For the position of 1 lot, the loss will be $10.

The amount of loss doesn't depend on whether y'all open a position of $10,000 with the corresponding eolith using a 1:1 leverage, or your eolith is $1000 and yous use a 1:x leverage.

The leverage could exist dangerous only for 1 reason. When you use leverage you psychologically tend to increase the position volume despite the rules of take chances management. With the increase in the position size, the pip value as well increases, which magnifies the potential loss.

College leverage can suggest that the trader's strategy has inverse. Most frequently, the leverage is increased in order to open positions with larger volumes or to increase the number of trades, and then, increase the potential turn a profit. Yet, if the total lot volume increases, the pip value also increases, and and so you may confront a bigger loss if the price reverses and goes confronting you.

In that location is no single formula to calculate the leverage. It depends on the trading nugget, deposit amount, and trading volumes, which are supposed to be held on the business relationship co-ordinate to your take a chance management system. Before yous calculate the Forex leverage, you should empathize that the smallest cost increase for a particular time is indicated equally a pip. There is a special leverage computer that yous can apply to calculate the leverage.

Conclusion

Financial leverage is a tool that allows a trader to boost the position volume or to reduce the margin requirement (collateral), thus sparing the funds to open other positions. Leverage is a high-take a chance trading tool if the full volume of positions exceeds the deposit percentage suggested past the risk management arrangement.

To calculate optimal leverage, ane can apply the forex margin calculator or brand up an Excel tabular array, which will demonstrate the alter in the position volume with an increase in the leverage. So that yous will encounter the biggest price move in pips to reach a finish-out level.

Do you have any questions on how to trade in Forex with leverage? Write your questions or conclusions in the comments!

P.S. Did you lot like my article? Share it in social networks: it will be the all-time "thank you" :)

Ask me questions and annotate below. I'll exist glad to answer your questions and requite necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The organisation allows you to merchandise by yourself or copy successful traders from all across the world.

- Use my promo-code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/liteforexengchat. Nosotros are sharing the signals and trading experience

- Telegram channel with high-quality analytics, Forex reviews, training manufactures, and other useful things for traders https://t.me/liteforex

The content of this article reflects the author's opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes merely and should not be considered as the provision of investment communication for the purposes of Directive 2004/39/EC.

Source: https://www.litefinance.com/blog/for-beginners/forex-leverage/

Posted by: torresfreardly.blogspot.com

0 Response to "Define Leverage In Forex Trading"

Post a Comment